* Content not generated by ChatGPT *

This model calculates the real cost of claim lag in workers compensation and provides an easy ROI justification for a FROI/FNOL application. It leverages studies and data released by NCCI as well as Hartford Financial Services Group. The cost projections illustrated here are for a hypothetical carrier with a workers compensation book of $100MM in written premium, a combined ratio of 87%, a loss ratio of 48%, 1,800 open lost time claims and an average lost time claim cost of $27,000 (measured at 18 months from claim initiation).

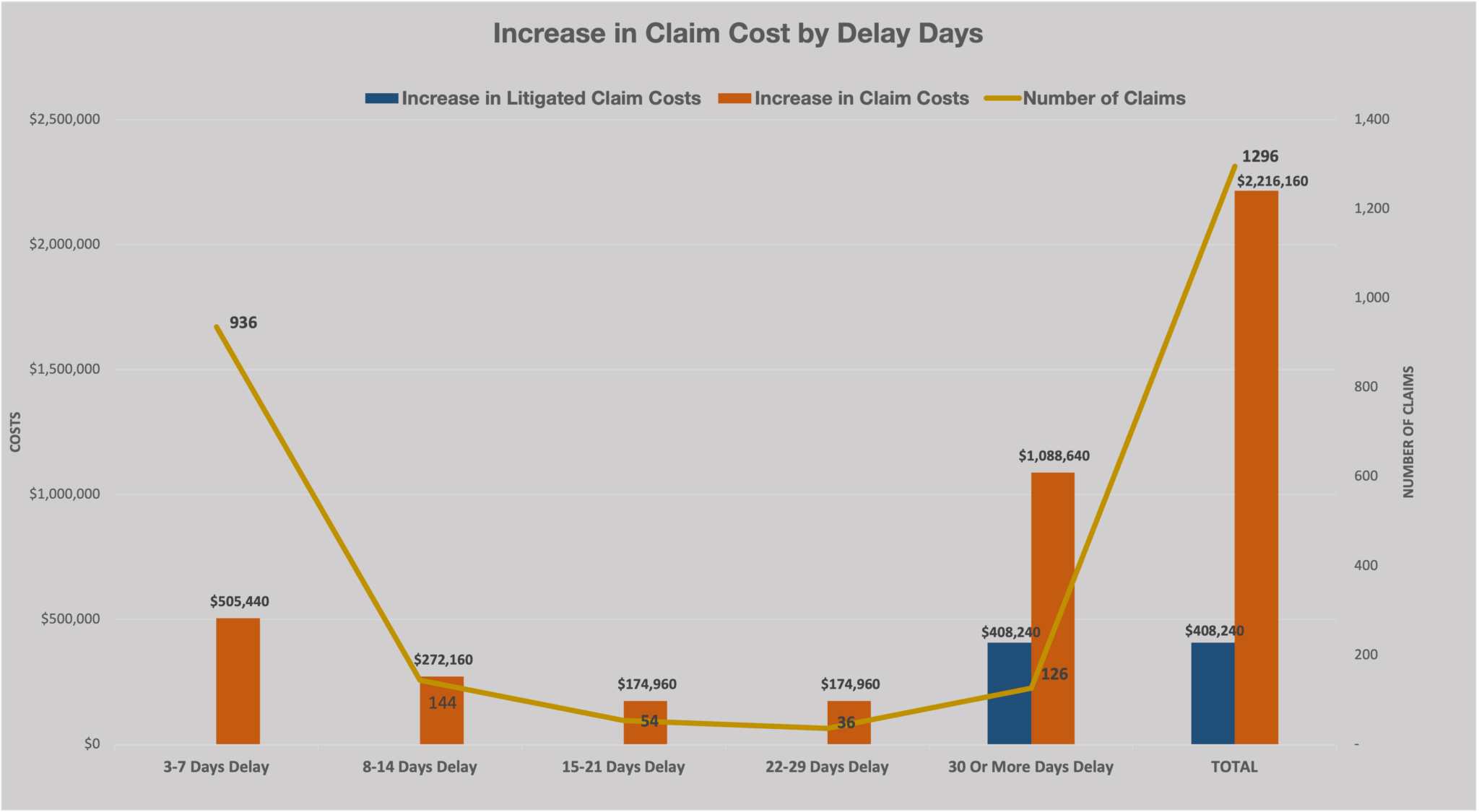

3 to 7 Days Delay

There is a 2% increase in claim costs and 52% of total lost time claims fall in this bucket. Claim reporting lag increases claim costs by $505,440.

8 to 14 Days Delay

With a 7% increase in claim costs and 8% of total lost time claims falling in this bucket, claim reporting lag increases claim costs by $272,160.

15 to 21 Days Delay

With a 12% increase in claim costs and 3% of total lost time claims falling in this bucket, this reporting lag increases claim costs by $174,960.

22 to 29 Days Delay

With a 18% increase in claim costs and 2% of total lost time claims falling in this bucket, the claim reporting lag increases claim costs by $174,960.

30 Or More Days Delay

With a 32% increase in claim costs and 7% of total lost time claims falling in this bucket, this reporting lag increases claim costs by $1,088,640.

Litigation costs due to claim reporting lag in this bucket account for $408,240 in claim cost increases.

Cost of Claim Lag (Delay Days)

Reporting lag of 3-7 days increases claim costs by 2%.

Reporting lag of 8-17 days increases claim costs by 7%.

Reporting lag of 15-21 days increases claim costs by 12%.

Reporting lag of 22-29 days increases claim costs by 18%.

Reporting lag of 30 days or more increases claim costs by 32%

Number of litigated claims increase by 32% when reported greater than 29 days late and cost 40% more.

The annual cost of claim lag in this example is estimated to be $2.2 MM with an additional $400K in litigation costs. This $2.6 MM of annual claim lag related costs may be reduced significantly using our FROI/FNOL solution. An IntelliFROI implementation with limited adoption that results in a 20% reduction will provide annual savings of $520K. The ROI for our IntelliFROI tool is just a few months.

Source: AIS and SOTL studies released by NCCI between 2015 to 2022 and studies on claim lag by Hartford Financial Services Group

Occupational disease (OP/OD) claims have not been included.

Claims reported within the first two days of injury have not been considered as there is no increase in claim costs during this reporting delay period.

The NCCI studies provide data from 44 states.

Losses are measured at 18 months from claim open. Lost time claim frequency increased by 3% in 2021 (including Covid-19 claims) while premiums went up by 1%; and medical and indemnity severity both remained the same in 2021.

Waiting periods vary by state but do not affect claim lag

Litigated claim costs are higher than indicated in our model. There is no clear litigation related data available for less than 30 days of claim lag. This model includes litigated claims that are reported late by 30 days or more. Such claims increase by 32% in count and cost approximately 40% more to close than non-litigated claims.

Sandeep Mehta